Source: Mysteel My Steel Net

1、 Starting from 2024, the United States will significantly increase tariffs on electric vehicles and lithium batteries from China

On May 14th, the US released the results of the four-year review of the imposition of the 301 tariff on China, announcing that it would further increase the tariffs on electric vehicles, lithium batteries, photovoltaic cells, key minerals, semiconductors, steel and aluminum, port cranes, personal protective equipment and other products imported from China on the basis of the original 301 tariff on China.

Table: Details of US imposed 301 tariffs on China

Product Item (Original Text) Tariff Action Event Plan (Original Text) Product Item (Reference Translation) Tariff Action Event Plan (Reference Translation)

Battery Parts (non lithium ion batteries) Increase to 25% in 2024 Battery Parts (non lithium-ion batteries) Increase to 25% in 2024

Electric vehicles Increase to 100% in 2024 Electric vehicles will increase to 100% by 2024

Facemasks Increase coverage to 25% in 2024, increasing mask coverage to 25% by 2024

Lithium ion electric vehicle batteries Increase productivity to 25% in 2024, with lithium-ion electric vehicle batteries increasing to 25% by 2024

Lithium ion non electric vehicle batteries Increase the rate to 25% in 2026 and increase it to 25% by 2026

Medical gloves increase the incidence rate to 25% in 2026 and increase it to 25% by 2026

Natural graphite Increase to 25% in 2026 Natural graphite will increase to 25% by 2026

Other critical minerals increase productivity to 25% in 2024, while other key minerals increase productivity to 25% by 2024

Permanent magnets Increase productivity to 25% in 2026, with permanent magnets increasing to 25% by 2026

Semiconductors Increase to 50% in 2025 Semiconductor 2025 to increase to 50%

Shiptoshorecranes Increase rates to 25% in 2024, with shore cranes increasing to 25% by 2024

Solar cells (whether or not assembled into modules) Increase the rate to 50% in 2024, and increase it to 50% by 2024

Steelandaluminum products Innovation rate to 25% in 2024 Steel and aluminum products to increase to 25% in 2024

Syringes and needles Innovation rate to 50% in 2024 Increase to 50% for syringes and needles by 2024

Data source: OfficeoftheUnitedStatesTradeRepresentative, Shanghai Steel Union

Among them, the tax rate for electric vehicles has been increased from 25% to 100%; The tariffs on power batteries and materials will be increased from 8.5% to 25%; The tariff on energy storage batteries will be increased from 8.5% to 25%; The tariff on high-energy batteries (whether assembled into components or not) will increase from 25% to 50%.

2、 The short-term impact of the US tariffs on the domestic electric vehicle industry is limited

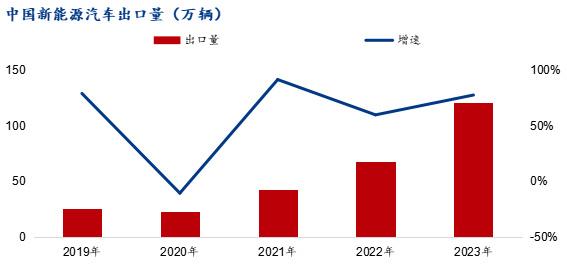

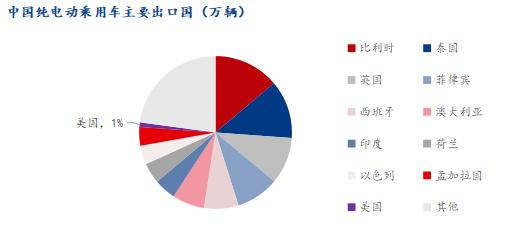

According to data from the China Association of Automobile Manufacturers, China's automobile exports reached 4.91 million units in 2023, including 1.203 million units of new energy vehicles, a year-on-year increase of 77.6%. Intelligent electric vehicle products with novel and fashionable appearance are increasingly favored by overseas consumers, and the brand image and premium ability of Chinese cars overseas have also been enhanced. Although the overall export of new energy vehicles is growing rapidly, it is mainly focused on the European and Southeast Asian markets. According to data from the China Association of Automobile Manufacturers, the top three markets for China's new energy passenger vehicle exports in 2023 are Belgium, Thailand, and the United Kingdom; Only 12400 vehicles were exported to the US market, accounting for 0.8% of the total export volume.

Almost all the car models exported to the United States are Geely automobiles. According to data from the China Association of Automobile Manufacturers, Geely Automobile is also the only Chinese automaker to export cars to the United States in the first quarter of 2024, with an export volume of only 2217 vehicles. According to the official production and sales report disclosed by Geely Automobile, the cumulative sales of Geely's new energy vehicles in the first quarter of 2024 reached 144125 units, a year-on-year increase of 143%. Among them, exports account for 1.54% of the total sales volume. According to industry insiders, Geely Automobile may supplement its production capacity in the United States. (The Volvo South Carolina vehicle factory it owns can achieve local production through its American factory.)

For the US market, the current penetration rate of electric vehicles in the US automotive market is still less than 10%, with Tesla occupying half of the US electric vehicle market; In the first quarter of 2024, North American car companies sold 372000 vehicles, of which Geely's sales accounted for only 3%. Although the data shows that its impact on the local market is relatively limited. But with the increasing demand for intelligence among the American consumer group and the growing interest in new energy vehicles in China, the imposition of tariffs undoubtedly hinders their choices.

For the domestic market, in terms of the total export volume, the impact of tariff increases on current exports is relatively limited. However, in the long run, there is still significant growth potential in the European and North American markets. This measure by the United States may put some pressure on the future development of China's new energy vehicle market. In the short term, it will also interfere with the export business of domestic car companies.

3、 Strengthening policies to expand overseas has become an inevitable choice for Chinese battery companies

According to customs statistics, the United States has been the top destination for China's lithium battery exports for four consecutive years from 2020 to 2024.

The total export value of China's lithium-ion batteries to the United States in 2023 was 13.638 billion US dollars, a year-on-year increase of 33.89%, accounting for 20.8% of China's lithium-ion battery export value. Among them, the export value of lithium-ion batteries from Fujian, Guangdong, Shanghai, and Jiangsu to the United States accounts for 81.2% of the national lithium-ion battery export value. Among them, Fujian is the largest source of China's lithium-ion battery exports, with an export value of 4.565 billion US dollars, accounting for 33% of China's total lithium-ion battery exports to the United States; Guangdong ranks second with an export value of 3.334 billion US dollars, accounting for 24% of China's total lithium-ion battery exports to the United States; Shanghai ranks third with an export value of 1.735 billion US dollars, accounting for 13% of China's total lithium-ion battery exports to the United States; Jiangsu ranks fourth with an export value of 1.433 billion US dollars, accounting for 11% of China's total lithium-ion battery exports to the United States.

The IRA bill in the United States poses significant uncertainty for non North American companies involved in the new energy vehicle and battery industry chain to enter the US market, and the increase in tariffs further affects the development of China's new energy in overseas markets.

In the first quarter of 2024, the United States remains the largest export destination for Chinese lithium batteries, accounting for 22% of the total export value. From the data display results, the restrictions on the Chinese market imposed by FEOC in the IRA bill have been reflected in the export data for the first quarter - the amount of lithium batteries exported from China to the United States in the first quarter decreased by 11% year-on-year, and the export quantity decreased by 4.4%. The exported lithium batteries were mainly supplied by CATL to Tesla.

In December 2023, the United States released the "Guidelines for Foreign Sensitive Entities", which stipulate that from 2024 onwards, new energy vehicles eligible for tax credits shall not include any battery components manufactured or assembled by foreign sensitive entities (FEOC); Starting from 2025, clean vehicles eligible for tax credits shall not contain any key minerals extracted, processed, or recycled by FEOC

In order to hedge potential risks, going global and entering the international market has become an inevitable choice for battery companies. From 2022 to 2023, domestic battery companies will continue to expand overseas, including CATL, EVE Energy, Honeycomb Energy, Guoxuan High Tech, and many other domestic lithium battery companies that have officially announced the establishment of factories overseas; In 2023, a total of 13 domestic lithium battery companies will go overseas to build factories (including signing contracts, announcements, construction, etc.). In addition, positive electrode material companies such as Xiamen Tungsten New Energy, Rongbai Technology, and Huayou Cobalt have also expanded their production capacity in multiple overseas locations.

But from the perspective of layout areas, the main targets for domestic production capacity to go global are Europe and Southeast Asia. At the same time, there are also many challenges in building factories overseas. In addition to environmental and tax policies, labor and energy costs, infrastructure construction, public security, and other issues, they also face competitive pressure from local enterprises in Japan, South Korea, Europe, and America.

The main ways for China to respond to overseas trade protection include exporting production capacity, acquiring and licensing technology. However, facing the US market, domestic lithium battery related companies find it difficult to enter the US market through conventional methods such as factory construction and acquisition. Currently, only CATL has adopted a technology licensing model to expand into the US market.

In February 2023, CATL and Ford announced that they would collaborate on the production of lithium iron phosphate batteries at a new power battery factory in Michigan, USA. CATL has opened up a new model for domestic enterprises to go global by exchanging technology for the market

4、 The slow development of the lithium battery industry in the United States makes it difficult for local industries to meet demand

Although the United States has developed lithium battery layout technology earlier, patent applications are not active, and due to factors such as local labor costs, industrial systems, technical talent, and policy swings, the development of the US lithium battery industry lags far behind China. Therefore, the implementation time of tariff increases in lithium-ion non electric vehicle batteries and negative electrode materials is later than that of power batteries and electric vehicles.

Lithium ion non electric vehicle batteries are mainly targeted at the energy storage market. The tariff increase for energy storage batteries will be implemented in 2026. Currently, Japanese and Korean companies do not have mature lithium iron phosphate electrochemical systems, mainly relying on ternary systems. However, the use of ternary batteries in energy storage systems poses certain safety hazards. The application of lithium iron phosphate as a large-scale energy storage system is irreplaceable in the next 3-5 years, and the localization of battery technology requires time and uncertainty. Therefore, it is difficult to block China's lithium batteries in the energy storage field in the short term. The demand for energy storage batteries in the United States is gradually increasing, and currently Chinese battery companies are still the main suppliers. Meanwhile, in the field of negative electrode materials (natural graphite), it is difficult for domestic companies in the United States to achieve breakthrough growth in production capacity in the next three years.

5、 Short term limited impact on domestic industries and long-term hindrance to the development of global industries

Overall, the domestic electric vehicle and lithium battery industries have already made early adjustments to the measures taken by the United States. The recent imposition of the 301 tariff by the United States on China is more about emotions and the impact on the future development of domestic industries.

With the increase in the size and technological level of China's new energy vehicle market, as well as the rise of domestic independent brands, it has brought significant pressure to local car companies in Europe and America. China, Europe, America and other countries have launched a comprehensive and multi-level competition for the electric vehicle industry. Although Europe and America are vigorously supporting their own industrial chains, the results are not as expected. No matter what measures the United States takes, it still cannot stop the development pace of China's lithium battery industry in the short term. The future expansion of production capacity and emerging market demand will bring broader opportunities for Chinese industries.